rhode island tax table

Ad Compare Your 2022 Tax Bracket vs. Discover Helpful Information and Resources on Taxes From AARP.

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Your 2021 Tax Bracket to See Whats Been Adjusted.

. If your taxable income is larger than 100000 use the Rhode Island Tax Computation Worksheet located on page T-1. Get the inside scoop on what its really like to live in the suburbs through our interviews with local suburbanites. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower.

No action on the part of the employee or the personnel office is necessary. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. Page T-2 Continued on page T-3.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Rhode Island Income Tax Rate 2020 - 2021. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower.

The income tax wage table has changed. 2022 Rhode Island Sales Tax Table. Suburbs 101 is an insiders guide to suburban Living.

Find your pretax deductions including 401K flexible account contributions. More about the Rhode Island Tax Tables. This form is for income earned in tax year 2021 with tax returns due in April 2022.

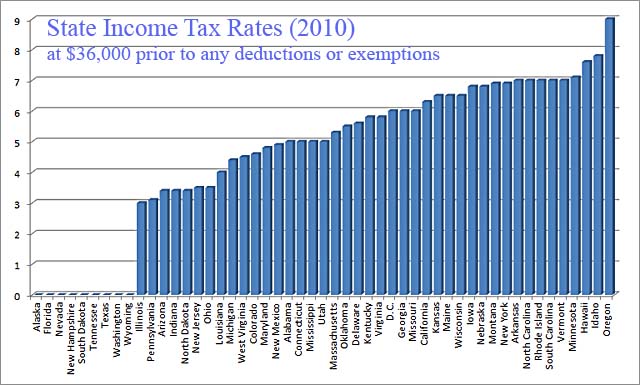

Rhode Islands maximum marginal income tax rate is the 1st highest in the. The Rhode Island Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Rhode Island State Income Tax Rates and Thresholds in 2022. This excise tax totals 34 cents per gallon.

If your taxable income is larger than 100000 use the Rhode Island Tax Computation Worksheet located on page T-1. Rhode Island Estate Tax. Rhode Islands 2022 income tax ranges from 375 to 599.

Below are forms for prior Tax Years starting with 2020. Rhode Island Gas Tax. 1 The employees wages are subject to federal income tax withholding and 2 Any part of the wages were for services performed in Rhode Island.

We last updated Rhode Island Tax Tables in January 2022 from the Rhode Island Division of Taxation. Rhode Island Alcohol Tax. According to the American Petroleum Institute the Ocean State has the 7th-highest tax on regular gas in the country.

Rhode Island Income Tax Forms. The Rhode Island tax rate is unchanged from last year however the. The tax on diesel is also 34 cents per gallon 9th-highest in the country.

Details of the personal income tax rates used in the 2022 Rhode Island State Calculator are published below. The state sales tax rate in Rhode Island is 7 but. The income tax withholding for the State of Rhode Island includes the following changes.

2020 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Download Or Email RI-1040NR More Fillable Forms Register and Subscribe Now. Exemption Allowance 1000 x Number of Exemptions.

Details on how to only prepare and print a Rhode Island 2021 Tax Return. EMPLOYEES FROM WHOSE WAGES RHODE ISLAND TAXES MUST BE WITHHELD. Check the 2021 Rhode Island state tax rate and the rules to calculate state income tax.

2200 2250 2300 2350 2000 2050 2100 2150 4000 Rhode Island Tax Table 2020 0 50 100 150 200 250 300 350. Providence has the highest property tax rate in Rhode Island with a property tax rate of 2456. Less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7.

Page T-2 Continued on page T-3. However if Annual wages are more than 227050 Exemption is 0. How to Calculate 2021 Rhode Island State Income Tax by Using State Income Tax Table.

These back taxes forms can not longer be e-Filed. The Rhode Island Income Tax. More about the Rhode Island Tax Tables Individual Income Tax TY 2021 We last updated the Income Tax Tables in January 2022 so this is the latest version of Tax Tables.

We will update this page with a new version of the form for 2023 as soon as it is made available by the Rhode Island. Unlike the Federal Income Tax Rhode Islands state income tax does not provide couples filing jointly with expanded income tax brackets. Look up your property tax rate from the table above.

A Rhode Island employer must with-hold Rhode Island income tax from the wages of an employee if. 2200 2250 2300 2350 2000 2050 2100 2150 4000 Rhode Island Tax Table 2018 0 50 100 150 200 250 300 350. Income tax tables and other tax information is sourced from the Rhode Island Division of Taxation.

Divide the annual Rhode Island tax withholding by 26 to obtain the. Find your gross income. Find your income exemptions.

Multiply the adjusted gross biweekly wages times 26 to obtain the gross annual wages. Apply the taxable income computed in step 5 to the following table to determine the annual Rhode Island tax withholding. The annualized wage threshold where the annual exemption amount is eliminated has changed from 234750 to 241850.

Less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7. However if Annual wages are more than 231500 Exemption is 0. 2019 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. Rhode Island State Income Tax Forms for Tax Year 2021 Jan. Apply the taxable income computed in step 5 to the following table to determine the annual Rhode Island tax withholding.

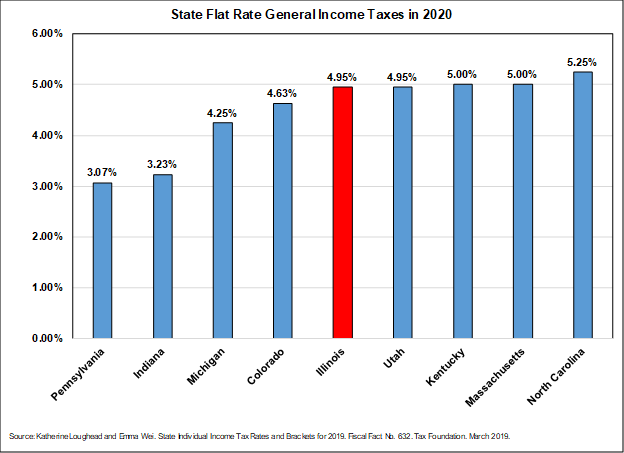

Rhode Island state income tax rate table for the 2020 - 2021 filing season has three income tax brackets with RI tax rates of 375 475 and 599 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. This page has the latest Rhode Island brackets and tax rates plus a Rhode Island income tax calculator. Rhode Island collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

Form Sales Tax Rate Table Fillable 7 Tax Rate

Pdf The Effect Of Personal Income Tax Rates On Individual And Business Decisions A Review Of The Evidence

Individual Income Tax Structures In Selected States The Civic Federation

Table 1 From The Earned Income Tax Credit Eitc Percentage Of Total Tax Returns And Credit Amount By State Semantic Scholar

Rhode Island Tax Credits Ri Department Of Labor Training

Rhode Island Ri Tax Refund Tax Brackets Taxact Blog

Historical Rhode Island Tax Policy Information Ballotpedia

Rhode Island Tax Forms And Instructions For 2021 Form Ri 1040

Combined State And Local General Sales Tax Rates Download Table

Form Sales Tax Rate Table Fillable 7 Tax Rate

Rhode Island Income Tax Calculator Smartasset

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation